Should you buy, hold or sell TechnologyOne shares?

The information technology sector can bring connotations of high-risk and low quality, but below I'll be outlining a long-term proven performer in the space that we've been consistently accumulating in Medallion's Fund.

TechnologyOne displays a robust balance sheet, high-quality clients and an extremely impressive long-term growth trajectory of revenues, margins and profits, with the share price following suit.

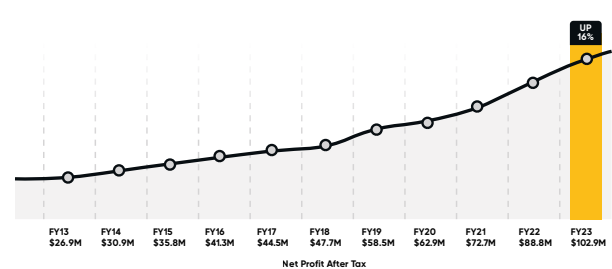

In their FY23 annual report, TNE recorded their 14th consecutive year of delivering record revenues and profits, a trend that doesn't appear to be slowing as governments and businesses continue their transition into the digital world.

Why invest in software?

For starters, I'd like to highlight the key reasons we like high quality technology businesses.

While it is relatively capital intensive to develop the software initially, these businesses are typically high margin, very scalable, capital light once developed and in most cases operate via a recurring revenue Software as a Service (SaaS) business model which delivers consistent cash flows.

The offerings are also quite sticky in nature given their complexity, along with the cost and hassle of clients changing to a competitor.

How did TechnologyOne become a powerhouse in software development?

TechnologyOne (TNE) primarily develops and provides Software as a Service (SaaS) enterprise resource planning (ERP) solutions.

With a market cap of $5.2 billion, they supply over 1200 large-scale companies and governments with software solutions that aim to streamline implementations, reduce time, costs, and risk for their customers throughout Australia, New Zealand, Asia, and the United Kingdom primarily.

To give a working example of their solutions, the City of Newcastle were using paper timesheets. With around 1200 employees and over 10 office locations, paper timesheets were manually filled out by staff, scanned and emailed (or physically collected), then admin staff would manually enter the data into the payroll system.

This paper-based process was incredibly time-consuming for all involved, not to mention the needless paper wastage.

The City of Newcastle, while already a TNE client, made the decision to digitise their business and upgrade to TNE's Connected Intelligence (CiA) platform.

This has automated the payroll function with an estimated 80% reduction in time spent, while also providing real-time payroll intelligence for management who had previously been using manual spreadsheets to assist decision-making. In addition to time-saving and intelligence, the process change also assists in achieving sustainability goals with an estimated paper reduction of around 12 tonnes per year and 1 billion litres of water required to manufacture the paper.

Payroll is the first process transition for the City of Newcastle, with financials, supply chain management and enterprise budgeting to follow through 2024.

How has TNW expanded its customer base?

Currently, TNE continues to win clients in the local government sector, where 25 deals were closed in FY23, totalling more than $113 million in contract value.

They also signed five larger government deals with a contract value of $23 million, the most notable being the Department of Veteran's Affairs, which was awarded to TNE at the conclusion of a tender process against German multinational giant, SAP (ETR: SAP).

In addition, TNE services around 60% of A/NZ universities and over 150 health and community services organisations. In the asset management and financial services offerings, TNE's software assists in the management of more than $300 billion in assets and infrastructure.

How is TNE increasing customer spending?

The business continues to transition existing clients onto the far more attractive SaaS model, bringing more consistent and predictable annual recurring revenues and moving away from the lumpy capital sales model used by software businesses in the past.

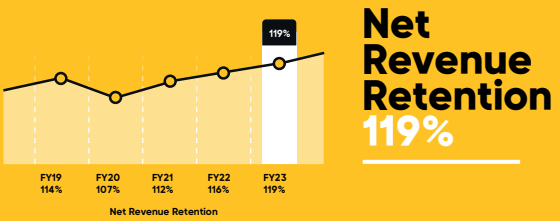

Particularly encouraging and highlighted below in the FY23 results was TNE's Net Revenue Retention of 119% (up from 116% in FY22), which is industry-leading in the ERP market and above their long-term target of 115%.

Net Revenue Retention essentially measures a company's ability to retain and expand customer spending, typically via upselling and cross-selling products to those existing clients, much like the City of Newcastle example noted earlier.

While still looking to drive new business, this maintenance and growth of current customers highlights the stickiness of their product, along with the ability of their sales team to identify areas where TNE can continue to introduce new offerings and drive further efficiencies for customers.

How is TNE continuing to surpass guidance?

TNE delivered impressive FY23 numbers with Profit before tax of $130 million - up 16% year on year, beating guidance of 10-15% growth. Total annual recurring revenue increased 23% to $392m and cash flow generation was up 36% to $105m, with management paying 19.52cps in dividends - up 15%, representing a 1% dividend yield. An impressive 38% Return on Equity indicates management are extremely adept in deploying capital and rather than pay a high dividend they can ideally reinvest back into the business, looking to generate long-term returns for shareholders above paying larger dividends now.

How robust is the TNE balance sheet?

TNE continues to strengthen their balance sheet with their cash and short-term investments position increasing from $175 million to $223 million. They also have no debt, which has shielded the company from the higher interest rate environment.

With no debt and a large cash balance, they are well positioned to capitalise on M&A opportunities or increase R&D spending to elevate their product offering, both of which we see as positives for the business and we have faith in management making the correct decisions in relation to the deployment of capital.

The beauty of acquisitions at the right price, is that not only would they pick up a complimentary software offering, but also a new customer base that can potentially become customers for TNE's existing suite of software offerings.

What is the outlook for TNE?

Medium-term guidance was upgraded for FY25 and TNE now expects to surpass $500 million annual recurring revenue by the end of 2025, a figure which was earlier targeted for the end of 2026.

At their most recent AGM, management were optimistic on their short-term growth, stating "the pipeline for 2024 is strong".

Further, they have stated that "we will continue to double in size every five years". TNE will report their FY24 half year results in late May and provide further guidance for the full year 2024.

Get stories like this in our newsletters.